Introduction

ASEAN is the Association of South East Asian Nations comprising the State/Government of Brunei Darussalam, the Kingdom of Cambodia, the Republic of Indonesia, the Lao People’s Democratic Republic, Malaysia, the Union of Myanmar, the Republic of the Philippines, the Republic of Singapore, the Kingdom of Thailand and the Socialist Republic of Viet Nam. ASEAN is the 6th largest economy and GDP growth from 2016 has been approximately 5.3% annually. It also has the 3rd largest population of 600 million with a relatively young population about half of which are under 30 years of age. This makes it a prime destination for relocation of labour intensive industries. ASEAN governments’ commitment to investing in infrastructure also suggests long term investment opportunities which attracts and encourages Foreign Direct Investment (FDIs)

From a macroeconomic perspective, the ASEAN story is generally positive and is one of the fastest growing regions with projected 4.9% GDP growth this year compared to projected global growth of 3.5%. Fast growing Myanmar is also projected for a growth of 7.5% next year, though for this country, regulations may slow the advancement of certain sectors. The ASEAN growth is projected to outperform that of global growth rate for the foreseeable future with relative political stability and increased connectivity in terms of both investment and trade.

Global trade has also re-emerged and as a result, Asia, that is the most export dependent has benefited substantially. Indicators suggest that domestic demand is also improving post slow down but it would take a while before this reaches a steady state. This could suggest investment opportunities in the medium to long term.

Inflation is behaving and the region as a whole is not sitting on any large imbalances. Therefore, with regards to concerns on fed hikes, as long as they are well introduced and earnings growth is faster than the rise in cost of capital, we should sift through the shifts in global monetary conditions.

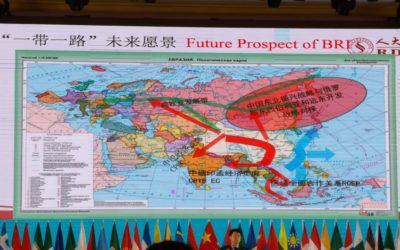

According to data, 10% of FDI into ASEAN in 2016 is from China and this is poised to increase due to One Belt One Road (OBOR) activities which will greatly enhance connectivity. Japan is also a great contributor of FDIs into ASEAN and is actively pushing outbound capital and M&A deals. 19% of M&A deals in ASEAN is inbound from China with the US coming in 2nd. The number one sector is undoubtedly manufacturing with services slowly gaining popularity.

The ASEAN Economic Community (AEC) blueprint which aims for tax collaboration by 2025 and reduction in trade transaction cost by 2020 also point to significant improvements in opportunities.

The AEC was formed to transform ASEAN into a stable, prosperous, and highly competitive region with equitable economic development, and reduced poverty and socio-economic disparities. The AEC is to be established in 2015 and is one of the pre-cursors to the ASEAN Community in 2020. The AEC aims to establish ASEAN as a single market and production base which comprise the following:

- Free flow of goods

- Free flow of services

- Free flow of investment

- Freer flow of capital; and

- Free flow of skilled labor.

In the course of consulting and advising investors internationally, there has always been reference to the two biggest economies in Asia – China and India; and a tendency to compare the same. This leads to critical mistakes. To those who have done business in India, doing business in ASEAN should indeed be familiar. China, in spite of its size and provinces (states), are commonly linked by Mandarin and communist governance. India, on the other hand, does not really have a common language in Hindi and is democratic with a quasi-federal system of governance. ASEAN is a far better example for comparison to India and vice versa.

All jurisdictions provide for business entry as sole proprietor, partnership, private limited company, public limited company and branch/liaison office. Some jurisdictions like Indonesia may permit only foreign investment limited liability companies and representative office and have been mentioned separately. Nearly all ASEAN countries project themselves to be at the heart of South East Asia.

Understanding of culture and customs cannot be stressed enough while doing business in South East Asia.

Singapore

It is the best destination to operate business in Asia from. Several common and oft repeated factors that contribute to this are:

- Business friendliness

- Integrity

- Regulatory transparency

- Corruption free environment

- Political, legal and financial stability

- Infrastructure

- Business integrity

- Cosmopolitanism

However, this is not all. The thrust in the past was on accounting and finance. Singapore has already established its reputation as a financial hub and being a nation that favours automation and technology. She has now trained its focus not only on technology and finance but towards fintech as well. Three articles have been published on business in through and around Singapore under LinkedIn Posts under the headings: “Doing Business in India from Singapore”; “Gateway to Asia: Singapore | Hong Kong” and “China India Investments: Sino-Indian ties or see no Indian ties” (contains a para on benefits of investing through Singapore).

Singapore is the 3rd richest nation in the world according to Global Finance and is the first in many areas and remains relevant by constantly reinventing itself. The political system is a parliamentary representative democratic republic. The legal system follows common law. Singapore recognizes 4 languages – English, Mandarin, Malay and Tamil. English is probably most spoken and used widely.

Macroeconomic View

As of the time of this article (November 2017), although exports point to good numbers, it is a very long hike for Singapore. Singapore is still sitting on period of very weak labour haul. Wage growth is very low and job creation has been negative for 5 quarters.

The opinion is that the economy still needs to go through a transition where wages come down, household reduce exposure to property market, etc. This is seen as an extremely long drawn process with no quick fix. Where historically there has been emergences of new sectors, the economy now is far too mature and rich for a new sector to emerge.

The economy needs to consolidate but in a more balanced fashion.

Investment

As is the case with highly developed economies and countries, the investment climate in Singapore is open and highly favourable with a regulatory environment only in the sectors of finance, professional services, telecom, real property, energy and media. There are no restrictions on reinvestment or repatriation of proceeds. Primary reasons for investment into Singapore are taxation, sophisticated workforce, infrastructure and connectivity to ASEAN, double taxation avoidance and free trade agreements with most countries in the world.

Challenges

The challenges of doing business in Singapore is that it is highly regulated and failure to comply leads to swift implementation of legal justice. Depending upon the industry or sector, there are licenses that need to be obtained. Therefore for businesses seeking to acquire a local company, it is not so much the due diligence of the target company but the post-integration and post-acquisition compliance that matter more for success.

Many Singapore companies, as well as foreign owned ones, have foreign operations. Where local participation is required, shareholders agreement should be carefully drafted.

Benefits

Tax benefits, safety, ease of doing business. Singapore has DTAAs signed with over 75 countries and many others pending ratification. See end of this article for other benefits as well.

Malaysia

Malaysia ranks fifty fifth amongst the richest nations. The dominant religion is Islam. The political system in the country is a constitutional monarchy under the Westminster parliamentary system and is categorized as a representative democracy. The law of Malaysia is mainly based on the common law legal system. The constitution of Malaysia also provides for state laws, secular laws (criminal and civil) and Sharia laws. The national and official language is Bahasa Malaysia or Malay. Local language in court proceedings is a requirement for Courts, at least lower courts, though they may waive it. Contracts may be in English though government contracts may contain both languages.

Macroeconomic view

GDP growth has come down to 5-5.5%. However, the negatives mainly come from government policies being completely focused onto supporting household sector and maintaining consumption growth. The repercussions of this is that savings rate is down, current account surplus moved from 14% of GDP to 1.6% in 5 years.

That being said, for the first time, metrics have improved slightly, external debt coverage stabilizing, liquidity conditions have improved, non-oil exports have increased.

As a whole, Malaysia is in a better place than 5 years ago, this is largely attributable to change in balance of payments and growth of non-oil and non-gas trade surplus.

Investment

Economic growth of Malaysia is driven by agriculture, mineral resource, electrical and electronics, forestry, oil and gas. Malaysia ranks highly in ease of doing business and its strengths lie in getting credit and protecting investors. Infrastructure is well developed and Malaysia even exports related services. 100% foreign equity participation in permitted in certain healthcare and educational services, department and specialty stores, telecommunications Application Service Providers (ASP), accounting and taxation services, courier services.

Many companies take full advantage of setting up company in Singapore and working in Malaysia where they gain from cheaper labour, land and costs. This is mutually beneficial as smarter companies can continue benefit from projecting its Asia-Pac HQ in Singapore as it main base. While engaging in contracts in Malaysia, it may be useful to note that dealing with decision-makers or senior management result in efficacious and expeditious business.

Malaysia has extensive and progressive legislation in the field of intellectual property rights protection. There are monetary threshold restrictions on real property ownership and approval would be required. There are exceptions as well.

Challenges

Incorporation as well as approval process and permits can take time. Local equity participation apply for various permits and licences. On internal front, its airline industry has not received the best of attention or feedback. The recent issues of proprietary and political imbroglio has also not helped in the presenting the best side of Malaysia.

Tax

Malaysia provides tax incentives for private limited companies and public limited companies. Malaysia has DTAAs with over 70 countries. Capital gains are taxed on real property gains and on exercise of employee stock options.

Vietnam

Vietnam ranks 132 amongst the richest nations. It is the only other communist state in SEA. The law in Vietnam is based on communist legal theory and French civil law. Vietnamese is the official language and official documentation are in Vietnamese. English is not commonly used as a language for business communication. Lawyers play an important role.

Investment

Vietnam is an important manufacturing hub for many international companies. Agriculture and seafood produce form major part of the economy along with mineral wealth and oil and gas reserves, making it attractive for global investors. 100% FDI is permitted along with investment through joint stock company or a business cooperation contract with a local partner. However, FDI requires an investment certificate that sets out the scope that the firm is allowed to cover. Time taken for registering a business in Vietnam can vary substantially from two to eight months depending on the complexity of the industry and the number of licenses required. Investors can apply directly to the authorities or through a lawyer.

Though Vietnam has comprehensive legislation relating to protection of IP, enforcement is an issue. On real property, foreign-owned entities are not allowed to own land, but can enter into leases.

Challenges

Local experts are a must while doing business in Vietnam. Documentation is in Vietnamese and multiple authorities/agencies may be involved for various licenses. Registering local entity procedures and obtaining of approvals are cumbersome. Due diligence reports may return many documents unfound or unfounded. Foreign ownership are capped at 30% (banking), 49% (public company), may not exceed 51% for some restricted industries, or is even prohibited altogether for some sectors.

Tax

Vietnam has DTAAs with about 38 countries. Capital gains tax is levied.

Indonesia

Indonesia ranks 122 amongst the richest nations. The dominant religion is Islam. The political system in the country is a republic with a presidential system. Law of Indonesia is based on a civil law system, intermixed with customary law (known as adat law) and the Roman Dutch law. These three systems co-exist along with new laws. The main language is Bahasa Indonesia, a variant of Malay which also functions as an official language for transactions and commercial documents. Local language in contract is a requirement for Courts.

Macroeconomic View

One thing to note is that the resource boom has faded. 2010-2012 saw growth at 6.5-7% and now this is at 5%. It is difficult to see how this is going to change in the short run. However, this generally points to macroeconomic stability in the Medium run, whether this is balance of payments, current account, inflation or reforms.

More importantly, the Jokowi administration has focused on structural reforms on improving the ease of doing business. World Bank released report and Indonesia jumped up 19 spots in ease of doing business. There is a focus on long term development from a structural perspective rather than short term gains and thereby currency runs as proven historically.- This can be seen as a positive development.

Major look out will be the elections which are due in 2019 which hopefully will not go into an era where populist measures start to dominated.

Economy is not in a great spot but there is no immense currency pressure in the market. Inflation is structurally low and households feel that prices are not going to go up. Balance of payment also is well-behaved which suggests that currency risk is not as high compared to last time.

From an M&A perspective, the indicators suggest to focus on micro-opportunities which lie in deep pockets which can still produce significant alpha.

The Indonesia story is that the next hike in Indonesia’s productivity and growth will come from broader macro productivity improvement rather than resources.

Investment

Economic growth of Indonesia is driven by performances in agriculture, mineral resources, coal, oil and gas. Nearly every sector has restrictions on foreign investment and participation. High priority economic sectors may be entitled to income tax benefits or tax holidays. There are Forex controls on repatriation of amounts. Infrastructure is a major target sector for investment. Foreign investment can own up to 100% of their business only in certain and very limited sectors.

Though Indonesia provides for intellectual property protection, the process of enforcement and defense is slow. Foreigners cannot own land in Indonesia. Many use convertible lease agreements or try to obtain strata title. These are however not established means.

Challenges

There are limits and investment caps across a variety of industries which range from 0% to 100%. Limited infrastructure increases the cost of doing business. However, Indonesia may have separate agreements with different countries, such as China on Chinese products, on taxation of products imported. Indonesia ranks 128th out of 185 countries in the World Bank’s Doing Business rankings. Contract enforcement and legislative transparency are major issues along with poor access to credit and high taxation. Incorporation process is protracted requiring at least 2 shareholders for companies. Transparency is an issue. Extensive due diligence is recommended.

Tax

Indonesia has DTAAs with over 50 countries. Capital gains are taxable as ordinary income and capital losses, deductible. Process of paying tax is rather onerous.

Thailand

Thailand formerly known as Siam ranks 85 amongst the richest nations. The religion followed by Thais is Buddhism. As of 2015, the Kingdom of Thailand continues to be under military rule. The law of Thailand is civil law with some sources of common law. General contracts can be in English and government contracts in Thai.

Macroeconomic View

Thailand is in a state of stagnation. GDP is largely driven by external sector (tourism) and government spending. – there has been a big gain in Chinese tourists.

Problem: Private investment is weak, confidence is weak. Outbound investment by Thai companies particularly in Mekong region has been greater than investment within the country. This shows longer term dynamics.

Economy is at 3-4 % growth with not much inflation, large current account surplus, lots of money and overvalued currency. Insights suggest that the economy is slowing and reaching a state of maturity before it becomes rich.

Investment

Thailand is the second largest economy in SEA and considered an emerging economy. It is ranked the 5th easiest place to do business in Asia. Tourism industry is substantial. Thai government incentives for FDI focuses on research and development, innovation and value creation investment. List of promoted sectors are – agriculture and agricultural products, mining, ceramics and basic metals, light industry, metal products, machinery and transport equipment, electronic industry and electric appliances, chemicals, paper and plastics, services and public utilities.

Thailand has progressive legislation in the field of intellectual property rights protection though enforcement used to be an issue. On real property, foreign-owned entities are not allowed to own land unless special conditions are met. Foreign nationals may buy condominiums units in Thai condos (shares in condominium corporations) subject to a cap of 40% of the units acquired by foreigners.

Challenges

Political stability and world markets affect Thailand investment outlook. Thailand is also subject to many a political unrest, strikes and bombings. Corruption remains an issue.

Tax

Income in Thailand from capital gains is taxed the same as regular income. If an individual earns capital gain from security in the Stock Exchange of Thailand, it is exempted from personal income tax.

The Philippines

The Philippines ranks 127 amongst the richest nations and is the only Christian nation in Asia. The Philippines is a unitary presidential constitutional republic, with the President of the Philippines acting as both the head of state and the head of government. The Philippine legal system is a blend of customary usage, civil law and common law systems. Constitutional law, procedure, corporation law, negotiable instruments, taxation, insurance, labour relations, banking and currency follow common law. English and Filipino are the official languages.

Macroeconomic View

The Phillipines have had long history of obstacles and continuously subject to crisis. They have faced periods of very weak growth and highly volatile currency markets. However, as a positive surprise, came, 2008-2009, where Business process outsourcing (BPO) industry took off. Similar to India in 2003, it came as positive surprise with regards to internal GDP growth.

This is an industry that grows at 20% year on year, which for a small economy, has a tremendous impact in growth.

What this also means is that the government now has finances to invest in infrastructure. In addition, private investment is also growing.

The Phillipines has had a tendency of very strong business cycle fluctuations. Credit is also growing very rapidly which is cause for concern. Furthermore, much of this credit is going to real estate sector. As a result, real estate prices are looking like a bubble.

This suggests a degree of misallocation of credit wherein inflation has risen. Therefore, it is prudent to tread with a degree of caution.

Things to look out for:

Tax reforms – a higher VAT and increase in charges of motor vehicles will go a long way. This would give the administration the finances to invest in infrastructure.

The Phillipines story: The long term looks positive but would suggest caution in the short term.

Investment

Agriculture constitutes the largest part of the economy. The Philippines is known for its workforce export. Investment by public-private participation in aviation, infrastructure, transport, water, healthcare and education is highly encouraged. Investment in to the Philippines is controlled with no FDI in certain sectors such as mass media, practice of professions, retail trade, and with local participation in others such as recruitment, construction, advertising, natural resources, gambling, finance. 100% FDI is permitted subject to stringent conditions.

The Philippines has made substantial progress in protection of IP and taken steps to bolster IPR by passing laws to improve and streamline enforcement.

Foreign-owned entities are not allowed to own land, but can enter into leases. Foreign nationals may buy condominiums units in Philippine condos (shares in condominium corporations) subject to a cap of 40% of the units acquired by foreigners.

Challenges

Local experts are a must while doing business in the Philippines. Registering local entity procedures and obtaining of approvals are cumbersome. There are many limitations to investing in the Philippines. Contract enforcement is slow. Business is conducted in a hierarchical structure and on consensual basis. Due diligence reports may return many documents unfound or unfounded.

Tax

The Philippines has DTAAs with about 36 countries. Capital gains tax is levied and there are various withholding tax rates.

Myanmar

Myanmar, erstwhile Burma, ranks 162 amongst the richest nations, but this means little and is considered by many as the last bastion of FDI. There is no official religion but Buddhism is followed by majority of the population. Though the country is making overtures towards democracy, the political system is currently in the hands of the military. The opposition does not appear to have a succession or continuing plan. The legal system is based on English common law, with many systems outdated and in the process of overhaul. The official language is Burmese. Business documentation may be in Burmese.

Investment

The economy is one of the least developed in the world. The major investors have been China, South Korea and India. Tourism is an area for foreign investment. Myanmar is rich in semi-precious stones, natural resources, oil and gas. The key FDI sectors are infrastructure (roads, power, telecommunications and logistics), oil and gas, manufacturing, mining, real estate, hotel and tourism. Business proceedings could be protracted and impeded by bureaucracy. Due diligence and definition of risk should be indigenised. Up to 100% foreign investment can be received in private limited companies. Some of the prohibited sectors relate to teak, forest plantations, petroleum and natural gas pearls, jade and precious stones, postal and telecommunications services, air and railway transport services, banking and insurance services, broadcasting and television services, metals, security and defense.

Intellectual property laws do not exist. Alternate protection may be sought in other laws. Foreign-owned entities are not allowed to own land, condos, apartments or any type of property in Myanmar under the current law, but can enter into leases.

Challenges

As is the case with many underdeveloped and developing countries, cost of stay in luxury hotels are comparable to developed countries. Cost of experienced and skilled professionals are also at a premium. Infrastructure and skilled workforce is an issue. Justice meted may be ambiguous and not necessarily independent of the Government.

Tax

Myanmar has DTAAs with about 10 countries and 8 of them have been notified. Capital gains tax is levied and there are various withholding tax rates.

Brunei Darussalam

Brunei is the fifth richest nation owing to its petroleum and natural gas fields. The official religion is Islam. The political system in the country is governed by the constitution and the national tradition of the Malay Islamic Monarchy. It has a mixed legal system based on English common law and Islamic Shariah law; the latter supersedes the former some cases, for instance, the sharia-based penal codes applies to Muslims and non-Muslims and exists in parallel to the existing common law-based code. Malay is the standard language, but English is widely used as a business and official language.

Investment

The investment climate in Brunei is open and highly favourable with limitations in the sectors of certain fields. The Government has been making an effort to diversify the economy and turn Brunei into a banking centre as well as an international offshore financial centre. National food security and those based on local resources require local participation. Industries for the local market not related to national food security and industries for total export can be totally foreign owned. Intellectual property protection is consistent with international norms. Areas of investment promoted by Brunei are: agri-food; downstream oil and gas and energy intensive industries; information and communication technology; life sciences (pharmaceutical, cosmetics, and functional health food and health supplements); light manufacturing; services, such as financial services and tourism; and other activities that may be technology driven.

Though there are IP laws, enforcement is an issue. Local partners are required for land purchase.

Challenges

The challenges of doing business in Brunei are relatively high cost of doing business; shortage of skilled and unskilled workers and lack of competitiveness of local products. Increase in institutional capacity of the government, including service delivery, and finance sector development need to be more effective. Other areas that need addressing are investor protection, ease of obtaining credit, and ease of doing business.

Tax

Brunei has DTAAs with about 20 countries. There is no capital gains tax. However, where the Collector of Income Tax can establish that the gains form part of the normal trading activities, they become taxable as revenue gains. The Government of Brunei Darussalam has also signed the Tax Information Exchange Agreement (TIEA). Unlike DTAAs, the objective of TIEA is to promote cooperation in tax matters through exchange of information between the signatory countries especially cooperation in countering abuses of the financial system.

Cambodia

Cambodia ranks 142 amongst the richest nations though the UN has classified Cambodia as a least developed country. It is arguably the fastest growing economy in Asia. The official religion is Buddhism and the political system in the country is constitutional monarchy where the governing powers of the monarch are contained by the Constitution. The legal system is primarily based on civil law system (influenced by the UN Transitional Authority in Cambodia), customary law, Communist legal theory, and common law. Khmer or Cambodian is the standard language as well as the official language.

Investment

Economic growth of Cambodia is driven by performances in garment manufacture, tourism, paddy and milled rice, and construction. Infrastructure is a major target sector for investment. Foreign investment can own up to 100% of their business or enter into joint ventures except in except in the sectors of cigarette manufacturing, movie production, rice milling, gemstone mining and processing, publishing and printing, radio and television, wood and stone carving production, and silk weaving. Investors invest in Cambodia for its low wages, liberal government policy on business, access to larger markets, and a country that offers extensive opportunities for tourism.

Intellectual property protection is consistent with international norms and Cambodia is a member of the World Intellectual Property Organization and the Paris Convention for the Protection of Industrial Property, and is a party to the ASEAN Framework Agreement on Intellectual Property Cooperation.

Land in Cambodia must be registered under a local person and locals are needed to oversee the development.

Challenges

Cambodians working in export sectors are typically recruited from among the rural poor. Trade, employment and poverty reduction are tightly linked in Cambodia. As a small and open economy that is highly dollarized, Cambodian economy is immediately affected by any changes in oil prices. Though the political environment appears stable, corruption and controversies are major factors. The administrative process for acquisitions can be highly complex and time consuming. Health care, limited infrastructure, low government salaries are some of the challenges of doing business in Cambodia.

Tax

Dividends, royalties (including rent and other payments connected with the use of property) and interest paid to a non-resident are subject to withholding tax. Other non-resident payments include withholding tax on compensation for management or technical services. Cambodia is not a party to any double tax agreements. Accordingly, no tax treaty relief from withholding tax is available.

Laos

Laos or the Lao People’s Democratic Republic is one of the poorest countries in SEA and featured as a developing nation. It is a communist state with a civil law system. The religion is Buddhism. Economy is mainly agrarian and natural resource exports. The legal system is based rule of the only party in Laos, the Lao People’s Revolutionary Party. The official and dominant language of Laos is Lao and laws are in Lao language. French is also used for communication.

Investment

Economic growth of Laos is driven by agriculture which accounts for 85% and tourism. Infrastructure is a major target sector for investment. The scope of investment lies in natural resources, tourism and agri-business from fertile agricultural land. It is a substantial supplier of hydroelectricity to China, Vietnam and Thailand. Legal entities take the form of partnerships, private and public limited companies.

Comprehensive IP law is much needed. There is a Prime Minister Decree on trademarks and patents for protection, but no copyright protection in Laos. IPR is still under development. On real property, land in Laos cannot be owned by non-residents but can be leased.

Challenges

There are many challenges to doing business in Laos. Human rights and corruption are major issues. The infrastructure in Laos is underdeveloped and more so in the rural areas. Legal recourse and enforcement could be arbitrary. Work force is unskilled, though low cost.

Tax

Laos has DTAAs with 8 countries: 5 ASEAN countries, N & S Korea and China and is in negotiations with Singapore and India.

Advantages of accessing ASEAN from Singapore

Some of the main benefits for foreign entities and individuals doing business in through and around Singapore are:

- Strategic location.

- Long term business success due to stability of DTAA implementation and limitation of benefits giving high credibility.

- Investing in Singapore for accessing international Stock Exchanges as well as reinvestment into ASEAN (as holding company).

- Access Singapore and international funds with representative in the Singapore company to invest in ASEAN.

- Investor comfort, confidence and safety towards ASEAN-incorporated, Singapore-promoted companies doing business in ASEAN.

- Easier to raise global funds.

- Governance premium by Singapore based entities.

- High quality and sophisticated work force and service.

- Intellectual property assets maintained in Singapore for worldwide deployment and centralized portfolio management.

- First point of protection of investor value into ASEAN.

- A second listing in SGX, a more conservative markets, after US, Europe and/or Australian markets provides excellent hedging and safer market. SGX is also an advantage to investors and promoters who wish to keep their investments voluntarily locked in for longer periods.

- Home for family offices (private wealth).

- Tax:

- For profits up to $S300,000 Singapore corporate tax rate is below 9% and capped at 17%

- 5 year tax holiday subject to qualifiers

- India corporate tax rate is 30% for residents and 40% for non-residents (goes up beyond 60%)

- Annual turnover of less than S$5 million are exempt from audit requirements

-

Dividends distributed by the Indian Subsidiary to the Singapore Holding is not subjected to withholding tax in India, subject to conditions.

![[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017](https://2ibpartners.com/wp-content/uploads/2017/11/B87I9434-400x250.jpg)