The future is now. Well, in some cases, the future is past. The sci-fi movie Blade Runner, made in 1982 and 2017, set the future in 2019. It got some things right (or at least headed that way in terms of flying cars and “android” helpers) and some things wrong (like...

The Future Employee

The future is now. Well, in some cases, the future is past. The sci-fi movie Blade Runner, made in 1982 and 2017, set the future in 2019. It got some things right (or at least headed that way in terms of flying cars and “android” helpers) and some things wrong (like the internet and social media). But it seems there will always be employees.

Thus far, employees are created from a particular education system. Formal education trains humans to understand existing technologies and systems and prepares them to join the system. After 20 years of schooling, the student is expected to pick a career. Everyone is born unique. Unfortunately, education standardizes them. Today, each person is not measured by her/his worth, but by pitching them against others studying the same standards.

So, what is the current education crop looking like? We are talking about Generation Z, the post-Millennials, born near 2000s (Bloomberg says aged between 7 to 22 in 2019), born post-internet. 2020’s tiesagers (passed teenage into tiesage). Gen z’s education brings in new approaches to education in terms of entrepreneurship, digital technology and personal branding at an early age. They are digitally literate (as opposed to educated). Preference for education in humanities are decreasing and STEM (science, technology, engineering and mathematics) are increasing. Gen Z are currently physically armed with internet, social media voice, science and technology in their hands; and psychologically faced with social media stress, climate change, family relations; and still schooling and high cost of living. These are the current future employees (pardon the oxymoron).

But the current crop of gen x and millennials are also part of the workforce. They bring with them experience, perspective, history and probably wisdom. They are also in transition towards higher digital literacy.

In the past, things were fairly simple following a fairly well-defined process: study hard and get a job, stay with the organization for the entire career, work way up the corporate ladder and building a nice retirement package. Hindsight is 20-20 vision and all that. But this is becoming an exception.

The corporate objective is moving away from mere profitability and returns to shareholders. Future employees look for corporate responsibility as much as learning.

So, what is the future looking like to these employees? These leads to few questions:

Will AI and automation take over future careers? Will my co-worker or supervisor or supervisee be a robot?

The only constant is change. It has happened in the past when we moved from rewarding loyalty with retirement packages and wrist watches, to annual bonuses, to hire and fire policies. Thinking AI and automation will take over future careers is like asking if discovering fire will result in extinction. AI and Automation are tools to help us. Hence, the future employee will or need to move high up in value-chain – both individually and operationally. There will be a rapid rethinking on moving away from our comfort zones to catch up and keep up.

We are already reporting and responding to robots. Be it to chatbots or IVRs or designing our CVs to respond positively to AI screening. The idea is acceptance to the change. The future employee and employer will already be adaptable to such changes.

Is lifelong learning a wise investment?

What if I train my employee and the employee leaves to work with a competitor? The answer is what if you don’t train and the employee stays in the organization? Training employees is like playing mah-jong or poker. So long as there are only 4 players, the same amount will remain in the kitty and there will be no challenges and profitability. One must not look at one playing table, but the whole room full of playing tables. When organizations return trained employees to the workforce, the country gains with higher skilled employees.

The HR future

What is required of a future employee?

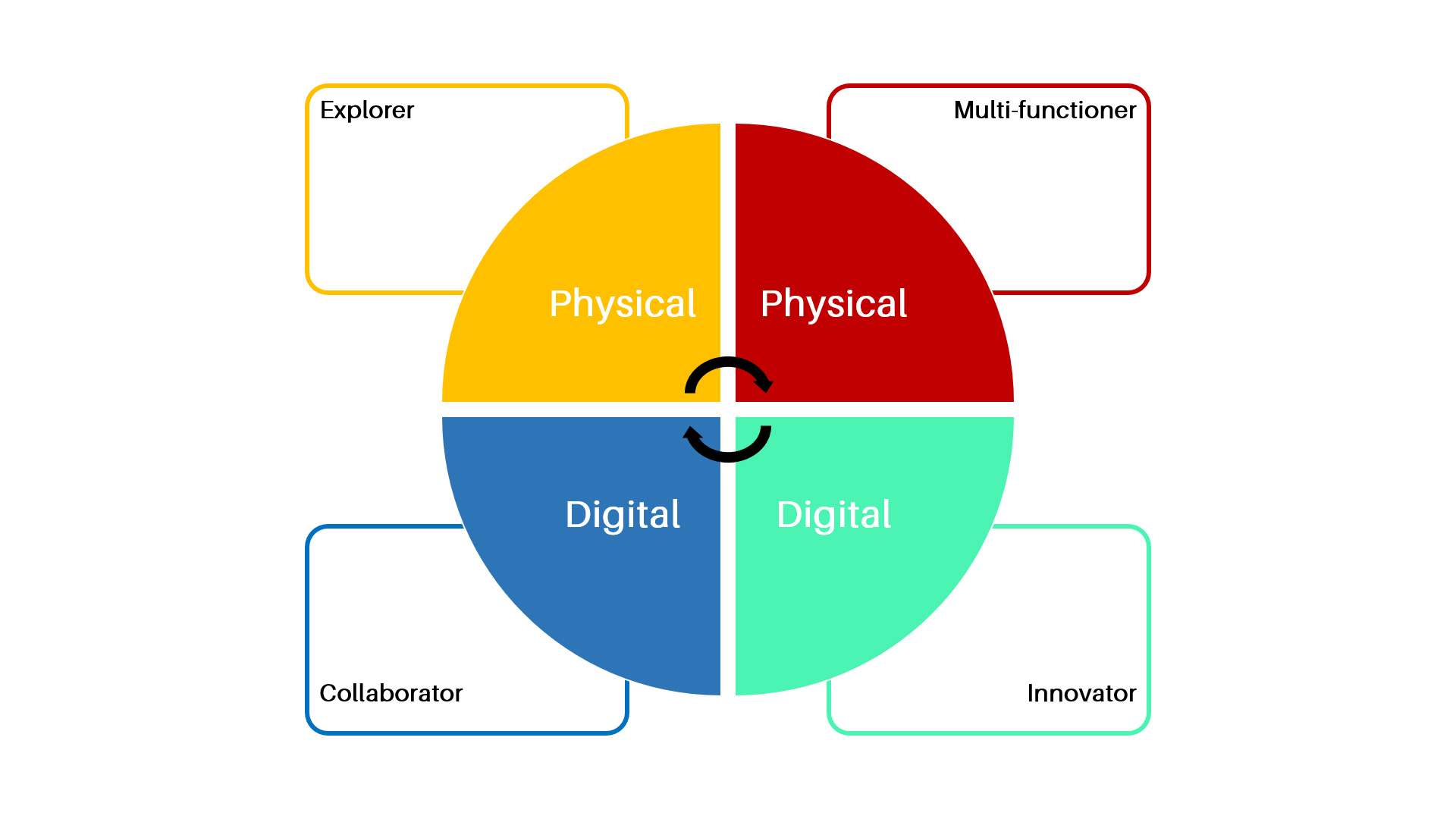

The future employees must be “twingineers” – with the ability to work in both the physical and digital space. They must learn to be an Explorer – Multi-functioner – Innovator – Team player. The future employee must engage in lifelong learning to stay relevant both within an organization and in the global business environment. They will learn greater adaptability to take on new jobs and new roles and older ones become redundant due to industry 4.0. The future employees must learn that constant digital transformation in an organization is a given. They will learn application of relevant technology as there are and will be many options that technology will provide. There will be no more low skill, routine jobs.

What is required of a future employer?

Employers must be twingineers as well. correspondingly must provide for quick lateral shifts to the future employee so as to provide a working environment best suited to their uniqueness. Jobs must provide for customization and flexibility. Organizations must provide for ability to work across gen x to gen z, incorporate a consistent and adaptable digital culture, bring in agile corporate standards and bureaucracy. Corporate constitutions can no longer be written in stone. Learning is no longer on-the-job, but what the employer invests in the employee in terms of lifelong learning. Organizations must make employees future ambassadors of their organization. They can prove that they are returning better employees and therefore better human beings to the world. Investment in digital transformation should not be near-term business operations; it is a long-term strategy. Digital transformation should not be to protect legacy ways of doing business, but true transformation of the business itself. Employers can attract new talent for near-term but must train existing employees for long-term. Such lifelong training must be uniform to facilitate uniform integration of various skills and outputs.

For partnerships, speaker and general business enquiries with 2iB Partners:

| Contact Person | Dylan Tan |

| Designation | COO |

| Dylan@2ibpartners.com |

YOU MAY LIKE

The Future Employee

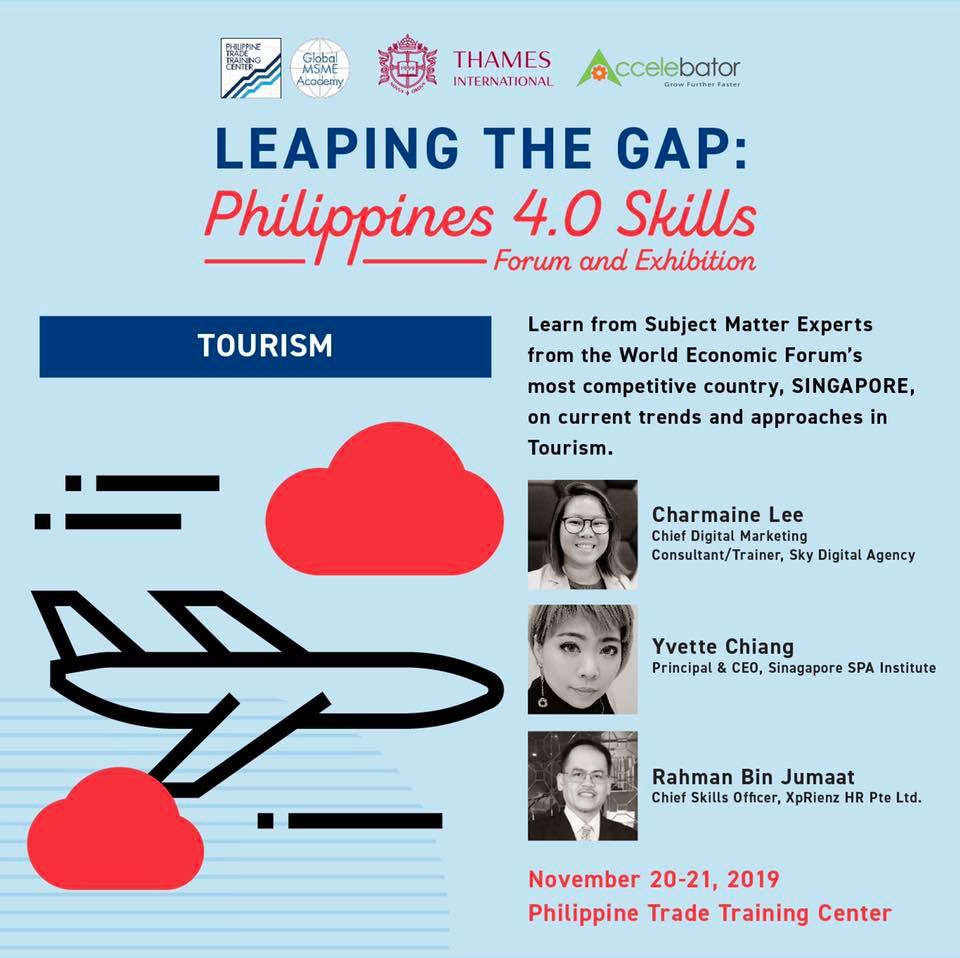

Philippines 4.0 Skills Conference | 20-21st Nov

In conjunction with Philippine Trade Training Center, Global MSME Academy, Thames International and accelebator, 2iB Partners will be speaking on Emerging Trends in Retail, HR Transformation and how to internationalize your business. Learn from 12 different...

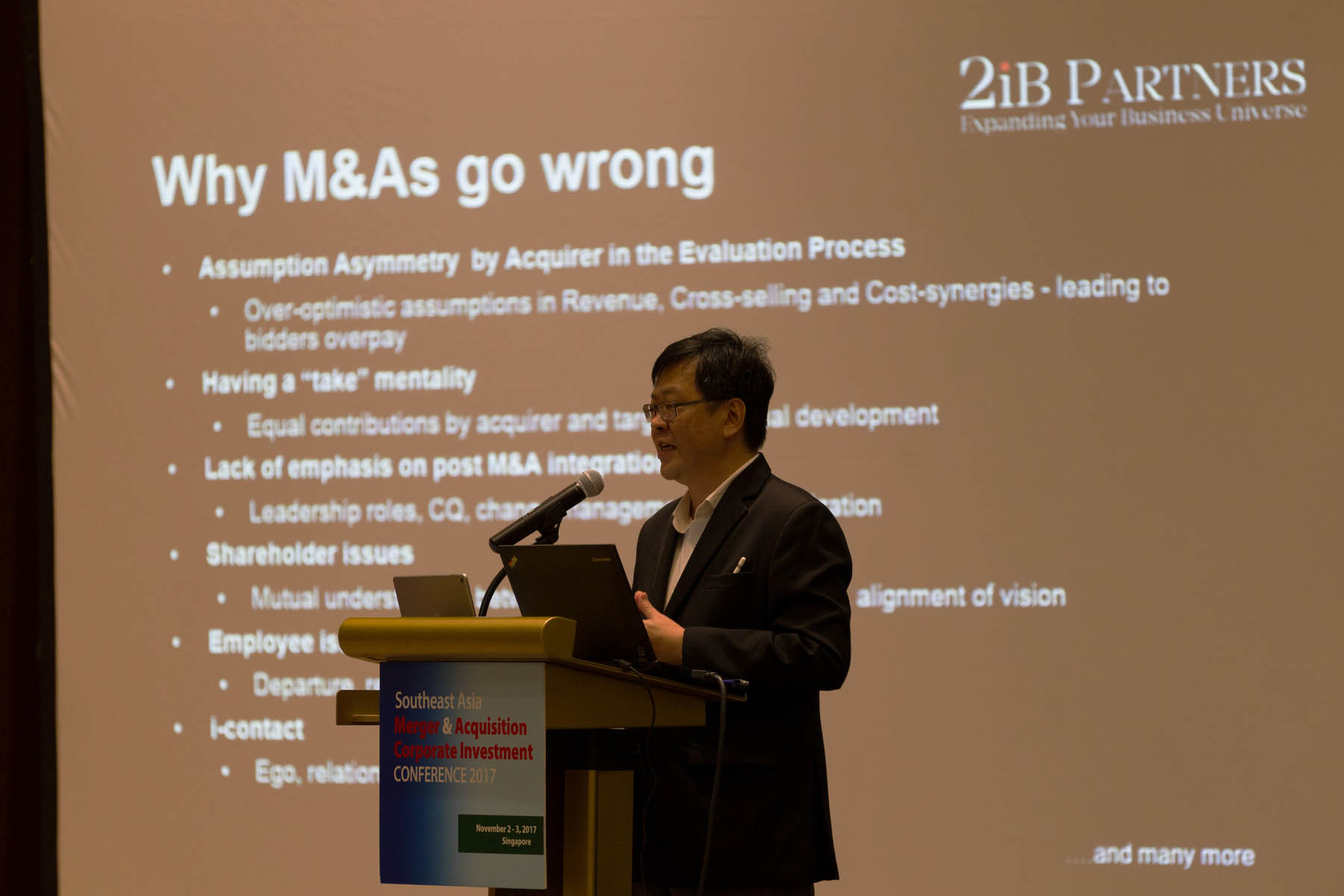

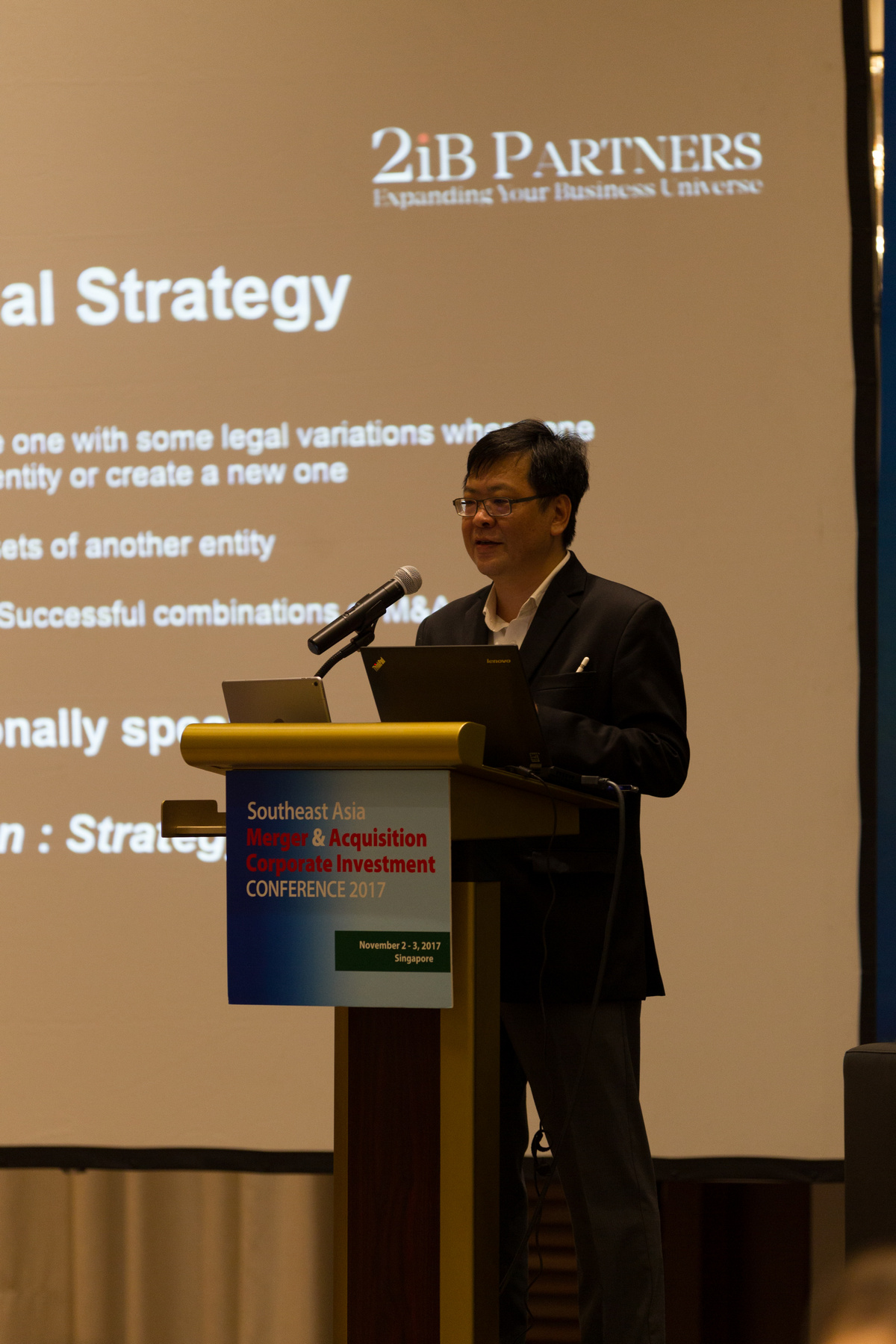

Mergers & Acquisitions – simplified. Or, a practical guide

M&A process

1. Strategy

2. Identification

3. Preliminary Due Diligence

4. Expressions of Interest

5. Detailed Due Diligence

6. Definitive Documentation

7. Post M&A

1. Strategy:

M&A begins with an idea in a company that helps it increase market share and access, t

Is having a Corporate Social Responsibility (CSR) program just a cost to your company?

Developing great companies that give back is more about devising a clear Corporate Social Responsibility (“CSR”) program aligned with the company’s goals and values rather than forcefully integrating CSR with their business strategies and goals. Instead of passing it off as a short term marketing gimmick, CSR should be seen as a long term investment strategy.

3 Key Notes Before Entering a New Market [Video & Transcript]

The above is a video taken during one of 2iB Partners master class where our advisor Mr. Richard Eu answers a question on “3 Key Notes Before Entering a New Market” by a business owner, Mr. Peh Zheng Yang. [Begin Transcript] Mr. Peh: You mentioned something like for...

Why is Instagram a Vital Part of your Marketing Strategy

Throw a stone and you will probably find someone who is taking a photo to post on Instagram. There has also been a strong push for consumer centric businesses to produce and develop products that are “Insta-worthy”. Whether it’s

![3 Key Notes Before Entering a New Market [Video & Transcript]](https://2ibpartners.com/wp-content/uploads/2017/06/map-1862587_1920-400x250.jpg)

![[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017](https://2ibpartners.com/wp-content/uploads/2017/11/B87I9434-1080x675.jpg)