Human Capital

Human capital may be defined as a measure of the economic value of an employee (from a contractor to the CEO). Measured by his skills, contribution, value and cost to his company. But if it is only measured by economic value, then the potential of that employee at different stages of his life or career is destroyed.

Before we proceed, let us make a simple differentiation between human resource and human capital. Human resources deal with the present. Managing what is there and applying it in the right silos. It is tactical. Human capital deals with all three tenses. It is strategic and should take into consideration issues beyond logic as well.

Data and statistics as we know only measures what was and projects on what it will be based on what was. So, if the employee makes a mid-career change that is far more profitable (even in terms of economic value), it cannot and will not be taken into consideration. One of the main reasons that I am no longer interested in chess is that while it used to be a game of strategy, today it is merely arithmetic and only measures your memory. Just like IQ tests only measure your ability to take an IQ test and not really your intelligence. I apply this analogy to measuring an employee merely by his current skill sets. Try getting a computer to put a value to a signature of Van Gogh at his time or a painter who just might be the next Pablo. Ergo, data will always be insufficient.

Some Observations Questions Hypothesis & Analysis

Digital Displacement

Investments should be made in people first, ideas next and issues last. I have been subject to a few interviews in my life by recruiters for jobs. But they were enough to make a lasting impact. My first observation was that interviewees to them are merely a database. The focus is always on the employers. Perhaps it is merely the law of supply and demand. After all, it is the employers that pay the recruiters. It is human tendency to think within the box, act on instructions and use forms and precedents to arrive at a hiring conclusion. In the fast approaching age of digital transformation, such boxers like the recruiters are ironically going to be displaced by technology first. This can be extended to similar professions like property agents, financial advisors, etc.

The Senior Professionals, Managers, Executives, Technicians (PMET) Conundrum

Another problem with human capital is the PMET Conundrum. Do we lay off PMETs or upskill and utilize them? Singapore has made valiant efforts to remain relevant by upgrading the silver workforce with SkillsFuture. While I fully endorse the effort, I am not sure about its intended outcome. Sometimes I see it as teaching an old dog new tricks. It is difficult. However, with due credit to Singapore, they at least offer you the opportunity and availability. Such efforts to upgrade one’s self must come from within the individual. Indeed, learning only stops when you are dead. So, can such persons and individuals be recapitalized or should they be invested in?

I believe redefinition and reallocation of their roles and change in perception is necessary. After all, persons like recruiters and PMETs also have the added advantage of being data points for future applications. If you haven’t discovered the worth in your employee, then the fault is yours solely.

Human capitalization and re-capitalization can be aggregated and deployed. The experiment comes later.

Concluding Points

Human capital, in my definition, is the analysis and application of resources from schooling to silver learning and investment therein. So, while this may not be achievable by and within a company or organization, it must come from various combined sources.

Every employee is equal to the mass of their experience and knowledge; and their contribution to company and society. The employee’s relative skill, worth, experience and knowledge changes over time and this need to be capitalized. The human capital is invested to provide profits or just more capital.

Persons such as recruiters, financial advisers, compliance experts, etc., should transform themselves into corporate psychologists to realign and relocate human capital. With all their recruiting experience and interviews, they should be in the best position to understand and differentiate the strengths and weakness, truth and cover ups, wheat and chaff of candidates.

PMETs should be recognized for their gold mine of practical skills, information and experience. They are a crucible of knowledge. A plethora of mentors. Their relative contributions over time should be thoroughly exploited. Fitting an engineer into the finance sector brought tremendous change in the way stock markets functioned. This is way I desire human capital seeing tapped and recapitalized.

Displaced, retrenched or redundant employees need not form part of a “Cost-Savings + Efficiency” exercise. Human capital should be redeployed into different sectors and the categories above serve that purpose efficiently.

Application of all of the above by a collection of companies – in the context of Singapore and other first world countries, export (on a reimport basis) and international interaction of this human capital to other countries, developed, developing and under-developed – will make a change to world economy as we know it.

So, invest in your people – your human capital and your great minds. Ideas will follow. The capitalized employee will fetch ideas which are after all an aggregation of data, thoughts – logical and illogical (takes 100 bullshit ideas to fertilize one good one) and a eureka moment. A good and smart investment, in terms of money or effort, in human capital will provide exponential returns to a group of companies. At least valuation of human capital is better realized than tech valuations. It is long term and not an exit strategy like some recently listed tech companies. Unless, I should wait for an application where I could upload all the collective experiences and knowledge of human capital onto a cloud platform and run algorithms.

For partnerships, speaker and general business enquiries with 2iB Partners:

| Contact Person | Dylan Tan |

| Designation | COO |

| Dylan@2ibpartners.com |

YOU MAY LIKE

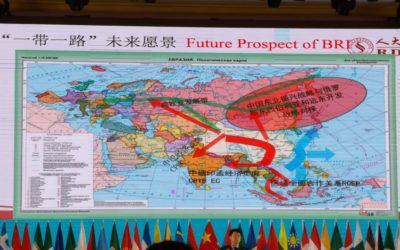

2iB Partners goes to Silk Road Summit 2018 in Zhang Jia Jie, China

15th Oct, 2018 - 2iB Partners attended the Silk Road Summit Conference in Zhang Jia Jie, China along with some other Singapore delegates. The conference was attended by Delegates from more than 80 countries attended the Summit, including former...

M&A – The Legal Angle

M&A - The Legal Angle The solution and problem in a merger or acquisition is regulatory in nature. In all cross-border deals, there is no go-around to regulations. Laws are enacted to essential protect life and property of its citizens. Therefore, it...

Why M&As Go Wrong

Acquisitions that are rushed can result in problems and challenges after closing in a transaction: Some of the reasons why M&As go wrong are: 1. Assumption Asymmetry Leaders and owners may over value a target by making assumptions including...

[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017

In the above video, Managing Director of 2iB Partners, Mr. Yang Yen Thaw delivers a 50 minute speech on Legal issues in cross-border Mergers & Acquisitions (M&A) and a new approach to M&A. 2iB Partners formed part of a repertoire of experts...

Panelist Commentary on Fintech in Healthcare: Partnerships & Regulatory Frameworks – 27 October 2017

A commentary by Yang Yen Thaw on his views in the panel discussion on Accelerating Innovation: Partnerships & Regulations on the topic "Fintech in Healthcare". The panelists were Yang Yen Thaw, Managing Director of 2iB Partners, Astrid S. Tuminez, Regional...

8 Points to consider for an IPO

In the previous parts, for Preparing your Company for a Liquidity Event, we covered: 8 Preparatory Steps 8 Considerations 8 Legal Points For the last installment of the series, we’d like to touch on a little on the supposed “holy grail” of companies – the...

![[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017](https://2ibpartners.com/wp-content/uploads/2017/11/B87I9434-400x250.jpg)