Liquidity events are usually an exciting and most looked forward to event in the business cycle. For some it means injection of new growth capital, for others it means cashing out their multi-million dollar exits. While it is certainly an event to look forward to, it is also something that should be planned towards.

Flashing back to part 1, a liquidity event is an exit strategy for investors to convert their equity into cash and occurs when any of the following typical change of control events takes place:

- merger

- acquisition

- sale purchase – part or whole, shares or assets

- leveraged recapitalization – debt to finance purchase of equity

- ESOP

- IPO of a company

The occurrence of liquidation, dissolution or winding up of a company may also be included as a liquidity event.

Here are 8 Considerations in the preparatory stage:

8 Considerations

Types of entity involved – company, trust, JVs. Regulation in cross-border related events.

Far as regulations are concerned, foreign direct investment regulations play a role in control over the target as well as limits on the amount of investment. Some countries place a particular valuation method over others and these will have to be adhered to. Compliance and recognition of an entity within the books of the target regarding the transactions would vary depending upon the type of entity. If a branch office of an acquirer is involved, there would be other considerations.

Cash Receipts or Pay-outs: in full or instalments. Earn out provisions. Shares or assets.

If the liquidity event amount is low or the target’s financial statements readily manageable, it could mean a bullet payment of a cash transaction. However, if the valuation is high, the pay-out may be partly in shares or partly in cash. The cash to be paid out will be based on performance and milestones achieved by the target over a period of time. This tends to keep the founder in place for an extended period and limits risk for the investor. If payment is made over a given period and liabilities emerge, the cash consideration could be affected as indemnities would kick in. A public company divestment or sale would result in a direct cash transaction with direct market price without valuation asymmetry.

Escrow consideration

One of the biggest considerations for the target is completing the transaction in the minimum time frame. An acquirer may make an offer out of belief that the transaction would pay for itself, and the question of whether the acquirer pays on time or has the capability to pay is relevant. Post-transaction, it would be difficult for the target to roll-back. Setting up an escrow or obtaining bank guarantees would be a way to offset the risk to the target. However, this may meet with resistance as no party would like to tie up their funds over a period of time where it can be put to other use. Many acquirers would also leverage the same funds by committing to different projects at the same time.

Type of equity. Voting provisions, restrictions in transfers, convertibility

Some liquidity events involve ordinary share transactions and some preference share transactions or a combination of both. The transactions may also be in the nature of bonds and convertible instruments. These shares may carry different voting rights. Some are compulsorily convertible at a given period and some indefinitely – meaning over a long period of time. Some countries may have restrictions on different classes of shares and shares carrying different voting rights. Targets may convert shares into one class before triggering a liquidity event. The manner of shareholding in private companies would be governed by documents such as shareholders or subscription agreement.

Value of equity. Volume weighted average if listed company

Valuations of shares may vary. Some of the methods are: Asset pricing (intrinsic value) – which are based on the real value of the assets; market value basis (yield basis or earning capacity) – where the effective rate of return on investment in terms of a percentage is taken into consideration; fair value basis – the mean of intrinsic value and yield value; return on capital – where predetermined or expected rates of return are applied; price-earnings ratio – the ratio of the market price of the share to earning per equity share; DCF – discounted cash flow where discounting of the profits (dividends, earnings, or cash flows) of the shares in the future and a final value on such disposal. In the case of listed companies, some use a fixed period volume weighted average of the existing share price and add a premium to it to make a public offer or tender. Goodwill is a factor that needs to be factored in while calculating the cost of equity. Much consideration may be swept under the goodwill valuation.

Local laws governing payment and transfer

Foreign direct investment or FDI regulations play a role in contracts for sale and purchase of shares involving different countries. It also addresses control over the target and limits on the amount of investment. Some regulations stipulate the valuation methods used. Compliance with registration of new owner and the type of entity would vary. For instance, some jurisdictions do not recognize trusts and only its trustees. While some countries may permit compensation for projected loss, others do not. Different countries also have different treatments on law and tax involving future equity, restrictions on different classes of shares and shares carrying different voting rights.

Effects on employment – local and international in cases of cross-border related events

Acquisitions on occurrence of liquidity events must take into consideration the effect on employment within the target. Post-acquisition may result in less than desirable effects on the economics and hence post-valuation of the company itself. In addition, effects on employment may hinder the liquidity event especially when trade unions are involved. Many governments take special care to see the labor market is not affected and this in turn affects the liquidity event.

Tax matters – double taxation in cases of cross-border related events.

During the sale of shares, taxation may be a driving factor for the type of shareholder who may be a trust, a listed company or as in the US a C-Corporation or an S-Corporation. Similarly, purchase may be made by a similar entity. In some cases, a joint venture may attract different tax considerations. Further, consideration should be given to double taxation avoidance agreements where tax paid in a country can be offset or credit claimed in the home country.

Stay tuned to Part 3: 8 legal points

For partnerships, speaker and general business enquiries with 2iB Partners:

| Contact Person | Dylan Tan |

| Designation | COO |

| Dylan@2ibpartners.com |

YOU MAY LIKE

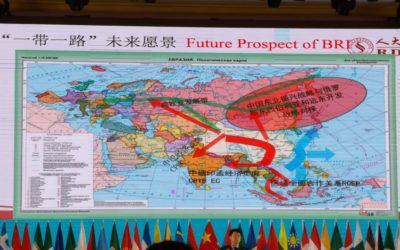

2iB Partners goes to Silk Road Summit 2018 in Zhang Jia Jie, China

15th Oct, 2018 - 2iB Partners attended the Silk Road Summit Conference in Zhang Jia Jie, China along with some other Singapore delegates. The conference was attended by Delegates from more than 80 countries attended the Summit, including former...

M&A – The Legal Angle

M&A - The Legal Angle The solution and problem in a merger or acquisition is regulatory in nature. In all cross-border deals, there is no go-around to regulations. Laws are enacted to essential protect life and property of its citizens. Therefore, it...

Why M&As Go Wrong

Acquisitions that are rushed can result in problems and challenges after closing in a transaction: Some of the reasons why M&As go wrong are: 1. Assumption Asymmetry Leaders and owners may over value a target by making assumptions including...

[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017

In the above video, Managing Director of 2iB Partners, Mr. Yang Yen Thaw delivers a 50 minute speech on Legal issues in cross-border Mergers & Acquisitions (M&A) and a new approach to M&A. 2iB Partners formed part of a repertoire of experts...

Panelist Commentary on Fintech in Healthcare: Partnerships & Regulatory Frameworks – 27 October 2017

A commentary by Yang Yen Thaw on his views in the panel discussion on Accelerating Innovation: Partnerships & Regulations on the topic "Fintech in Healthcare". The panelists were Yang Yen Thaw, Managing Director of 2iB Partners, Astrid S. Tuminez, Regional...

8 Points to consider for an IPO

In the previous parts, for Preparing your Company for a Liquidity Event, we covered: 8 Preparatory Steps 8 Considerations 8 Legal Points For the last installment of the series, we’d like to touch on a little on the supposed “holy grail” of companies – the...

![[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017](https://2ibpartners.com/wp-content/uploads/2017/11/B87I9434-400x250.jpg)