This is part 1 of 4 of an introduction to Preparing your Company for a Liquidity Event:

- 8 Step Preparation

- 8 Considerations

- 8 Legal Points

- 8 IPO Points

What is a Liquidity Event?

First and foremost, a liquidity event is an exit strategy for investors to convert their equity into cash and occurs when any of the following typical change of control events takes place:

1. merger

2. acquisition

3. sale purchase – part or whole, shares or assets

4. leveraged recapitalization – debt to finance purchase of equity

5. ESOP

6. IPO of a company

The occurrence of liquidation, dissolution or winding up of a company may also be included as a liquidity event.

This is usually an exciting and most looked forward to event in the business cycle. For some it means injection of new growth capital, for others it means cashing out their multi-million dollar exits. While it is certainly an event to look forward to, it is also something that should be planned towards.

Here are 8 steps that should be considered in the preparatory stage:

8-Step Preparation

Determine the team that will be involved in the transaction as well as the effect of laws and business in cases of cross-border related events. Apart from conducting an internal due diligence and legal audit which would help in sanitization and preparation, the following steps may be considered while preparing for a liquidity event.

1. Notes

Depending upon the type of liquidity event, the document providing for the liquidity event such as convertible notes, instruments for future equity, share purchase or stock acquisition agreements, funding and investments agreements should be reviewed. Any action needs to be sanitized before occurrence of the liquidity event.

It is also highly important to note where the important clauses are in each of these contracts and how they can be manipulated.

E.g:

Sample Liquidity Event Clause in a Share Purchase Agreement:

Upon the occurrence of a Liquidity Event (as hereinafter defined), the Borrower shall prepay the outstanding Principal Amount of all Notes in accordance with the redemption prices (the “Mandatory Redemption Prices”) set forth below (expressed as a percentage of the outstanding Principal Amount being prepaid), together with Interest accrued and unpaid on the outstanding Principal Amount of the Notes so prepaid through the date of such prepayment and reasonable out-of-pocket costs and expenses (including reasonable fees, charges and disbursements of counsel), if any, associated with such prepayment. If a Liquidity Event shall occur during any Loan Year set forth below, the Mandatory Redemption Price shall be determined based upon the percentage indicated below for such Loan Year multiplied by the Principal Amount which is being prepaid. For the purposes hereof, “Liquidity Event” means (i) the occurrence of a Change of Control, or (ii) the liquidation, dissolution or winding up of Parent or Borrower or of one or more of Parent’s Subsidiaries that, individually or in the aggregate, constitute a material part of the business, operations or assets of the Credit Parties and all of their respective Subsidiaries, taken as a whole.

2. Valuation

Obtain company valuation, of shares or assets, around liquidity event for negotiation. Many good deals fall apart due to unrealistic expectations of founders. While you cannot have unrealistic expectations, you shouldn’t have one that is too low either. In negotiations, it is always helpful to have an independent 3rd party valuation.

3. IP Portfolio

Identify and register all IP of the company, obtain licenses, review licensed products. Having an independent IP valuation would also help in the negotiation process since it is always cause for price differences.

4. Finance

Appointment or change in financial management. Exchanges in different countries will have different requirements for financial managers.

5. Audit

Conduct an audit to analyze revenue recognition and depreciation and amortization policy. Exchanges in different countries will have different requirement for audits.

6. Corporate & Contractual Compliance

Updating and review of minute books, confidentiality or non-solicitation or non-compete contracts, book of contracts, corporate records, accounting records, ESOP, third party consents.

7. Statutory & Regulatory Compliance

Updating of approvals and licenses, company law authority reporting, employment law compliance and tax compliance.

8. In-house counsel

In-house counsel will assist in controlling cost and preparing documentation as well as avoiding pitfalls. While most see the role as an additional cost centre, this may prove untrue. An in-house counsel knows exactly which areas to concentrate on, the right questions to ask and the right people to approach. On the broader scale, this would result in less time spent and lesser cost attached.

Stay tuned to the next few parts!

If you would like to learn more about Preparing your Company for a Liquidity Event, we are holding a 4-hour Masterclass on the 13th of November, 2017 at Singapore Business Federation Centre.

Early Bird discount available till 4th of November, 2017!

Click on the below to find out more!

For partnerships, speaker and general business enquiries with 2iB Partners:

| Contact Person | Dylan Tan |

| Designation | COO |

| Dylan@2ibpartners.com |

YOU MAY LIKE

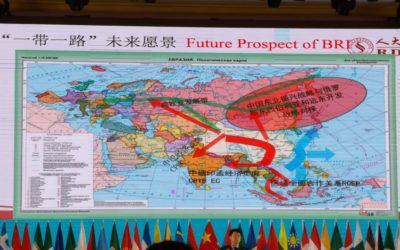

2iB Partners goes to Silk Road Summit 2018 in Zhang Jia Jie, China

15th Oct, 2018 - 2iB Partners attended the Silk Road Summit Conference in Zhang Jia Jie, China along with some other Singapore delegates. The conference was attended by Delegates from more than 80 countries attended the Summit, including former...

M&A – The Legal Angle

M&A - The Legal Angle The solution and problem in a merger or acquisition is regulatory in nature. In all cross-border deals, there is no go-around to regulations. Laws are enacted to essential protect life and property of its citizens. Therefore, it...

Why M&As Go Wrong

Acquisitions that are rushed can result in problems and challenges after closing in a transaction: Some of the reasons why M&As go wrong are: 1. Assumption Asymmetry Leaders and owners may over value a target by making assumptions including...

[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017

In the above video, Managing Director of 2iB Partners, Mr. Yang Yen Thaw delivers a 50 minute speech on Legal issues in cross-border Mergers & Acquisitions (M&A) and a new approach to M&A. 2iB Partners formed part of a repertoire of experts...

Panelist Commentary on Fintech in Healthcare: Partnerships & Regulatory Frameworks – 27 October 2017

A commentary by Yang Yen Thaw on his views in the panel discussion on Accelerating Innovation: Partnerships & Regulations on the topic "Fintech in Healthcare". The panelists were Yang Yen Thaw, Managing Director of 2iB Partners, Astrid S. Tuminez, Regional...

8 Points to consider for an IPO

In the previous parts, for Preparing your Company for a Liquidity Event, we covered: 8 Preparatory Steps 8 Considerations 8 Legal Points For the last installment of the series, we’d like to touch on a little on the supposed “holy grail” of companies – the...

![[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017](https://2ibpartners.com/wp-content/uploads/2017/11/B87I9434-400x250.jpg)