In this event, Managing Director, Yang Yen Thaw of 2iB Partners will join a panel of other experts to speak on cross-border M&A in South East Asia. 2iB continues to strengthen and develop it’s presence and network in cross-border M&A through strong synergistic partnerships with key players.

EXPLORING CURRENT TRENDS & STRATEGIES FOR

INVESTMENT AND M&A IN SOUTHEAST ASIA

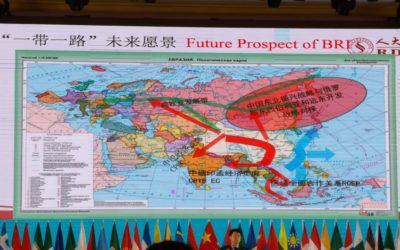

Southeast Asia is a dynamic market with nearly 700 million people, now this region is becoming the world’s most attractive destination for foreign investment. Greenfield investment and M&A activities increased rapidly in the past five years in this region. A lot of multinational companies are increasing the investments in this region due to the cost advantage and continuous opening policy, SEA now receives more foreign direct investment than China. Meanwhile, China is shifting the role from an investee to an outward investor. Following the ‘One Belt, One Road’ plan, China will become another big investor in Southeast Asia besides Japan. For multinational companies, how to capture the potential direct investment and M&A opportunities and managing their investment portfolios and maximize long-term value? And how to meet the legal, finance and culture challenges for the cross-border investments, these are very rich and interesting topics.

This year’s Southeast Asia Corporate Investment Merger & Acquisition Conference 2017 will be held in Singapore. This conference is an exclusive event for the corporate executives from the global multinational corporations to learn the latest trends and regulations affecting the cross-border investment in Southeast Asia. The event is also a valuable opportunity for business networking by exchanging the practical experience and lessons of direct investment, M&A, JV partnership in this region. Senior executives from MNCs, PE, VC and professional advisors for finance & tax, legal, management consulting, investment banking will join this year’s exciting event. We are looking forward to your participation!

Speaker list:

| Speaker | Details |

| Mr. Angelo Dell’ Atti | Global Head, Corporate Finance, IFC (International Finance Corporation) |

| Mr. Johnson Chng | Managing Director, Silk Road Finance Corporation |

| Mr. Patrick Ip | Managing Director, China-ASEAN Investment Cooperation Fund |

| Mr. Ryoichi Nishizawa | Global Head of M&A, Mitsubishi Corporation |

| Mr. Seth Sunderland | Executive Director, Investment Banking, M&A Asia, UBS |

| Mr. Saurabh N. Agarwal | Managing Director, Warburg Pincus |

| Mr. Hadi Cahyadi | Managing Partner and Founder, Helios Capital |

| Mr. Kevin Murphy | Managing Director, Andaman Capital Partners |

| Mr. Edwin Vanderbruggen | Senior Partner, VDB Loi Co.,Ltd |

| Mr. Alex Kimura | Chief Strategy Officer, Asia, Aviva |

| Mr. Sikh Shamsul | Foreign Investment Division, Malaysian Investment Development Authority |

| Mr. Greg Ohan | Director, Vietnam, Jones Lang LaSalle |

and many more!

For Registration:

Event is organized by Valuetang LLC. For registration and enquiries please contact : charles.shangguan@valuetang.com and jenny.wang@valuetang.com

For partnerships, speaker and general business enquiries with 2iB Partners:

| Contact Person | Dylan Tan |

| Designation | COO |

| Dylan@2ibpartners.com |

YOU MAY LIKE

2iB Partners goes to Silk Road Summit 2018 in Zhang Jia Jie, China

15th Oct, 2018 - 2iB Partners attended the Silk Road Summit Conference in Zhang Jia Jie, China along with some other Singapore delegates. The conference was attended by Delegates from more than 80 countries attended the Summit, including former...

M&A – The Legal Angle

M&A - The Legal Angle The solution and problem in a merger or acquisition is regulatory in nature. In all cross-border deals, there is no go-around to regulations. Laws are enacted to essential protect life and property of its citizens. Therefore, it...

Why M&As Go Wrong

Acquisitions that are rushed can result in problems and challenges after closing in a transaction: Some of the reasons why M&As go wrong are: 1. Assumption Asymmetry Leaders and owners may over value a target by making assumptions including...

[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017

In the above video, Managing Director of 2iB Partners, Mr. Yang Yen Thaw delivers a 50 minute speech on Legal issues in cross-border Mergers & Acquisitions (M&A) and a new approach to M&A. 2iB Partners formed part of a repertoire of experts...

Panelist Commentary on Fintech in Healthcare: Partnerships & Regulatory Frameworks – 27 October 2017

A commentary by Yang Yen Thaw on his views in the panel discussion on Accelerating Innovation: Partnerships & Regulations on the topic "Fintech in Healthcare". The panelists were Yang Yen Thaw, Managing Director of 2iB Partners, Astrid S. Tuminez, Regional...

8 Points to consider for an IPO

In the previous parts, for Preparing your Company for a Liquidity Event, we covered: 8 Preparatory Steps 8 Considerations 8 Legal Points For the last installment of the series, we’d like to touch on a little on the supposed “holy grail” of companies – the...

![[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017](https://2ibpartners.com/wp-content/uploads/2017/11/B87I9434-400x250.jpg)