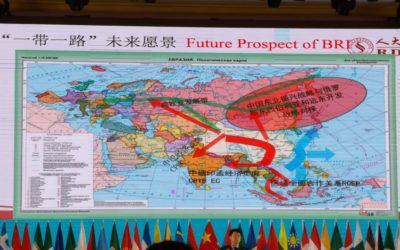

15th Oct, 2018 - 2iB Partners attended the Silk Road Summit Conference in Zhang Jia Jie, China along with some other Singapore delegates. The conference was attended by Delegates from more than 80 countries attended the Summit, including former...

The 4th Industrial Revolution and what does the future look like for SMEs?

The Conglomerate

The 1960s saw a plethora of conglomerates being used to raise finance with low interest due to their risk diversification and other factors. It was also glamorous to be seen owning diverse industries, like Woolies or Woolworths Group in UK. Free cash flows providing risk capital for investment and cross-selling between customer databases were some of the advantages. However, this was short lived as the conglomerate could not keep up with inflation, interest rate and manageability. It was difficult to sustain or justify the share price in the market. Conglomerates began consolidating, de-merging and returning to their core competencies.

The problems with conglomerates were many – cash management, costs, cross-subsidies, increased layers of often diverse management, decreased transparency in accounting and cash position, bureaucracy, inertia and difficulty in calculating true value of the stock. Spin-offs of subsidiaries of conglomerates to counter disruption or effective evaluate them were options, but too expensive to even consider. The conglomerate was no longer serving its purpose and are fast becoming disrupted with technology which contributed with increased confusion over digital, big data and data analytics due to their diverse nature. Take for instance conglomerates like Kodak who were too arrogant to recognize simple disruption by refusing to acknowledge digital photography.

The Digital Revolution

According to the World Economic Forum – “The First Industrial Revolution used water and steam power to mechanize production. The Second used electric power to create mass production. The Third (3IR) used electronics and information technology (technology) to automate production. Now a Fourth Industrial Revolution (4IR) is building on the Third, the digital revolution that has been occurring since the middle of the last century. It is characterized by a fusion of technologies that is blurring the lines between the physical, digital, and biological spheres”.

Technology brought about a new age of small businesses with big changes. Changes disrupting conglomeration. 3IR brought in a new age of entrepreneurship. Individuals began their own businesses. These companies brought in techies, nerds and geeks together to begin small but disruptive companies. The internet boom and bubble were born. With computers and the internet, the 3rd industrial revolution (3IR), everything began to change. Disruption. Information along with services and products were delivered at the doorstep. But traditional SMEs were scrambling to stay relevant. They still are.

4th Industrial Revolution

Riding on 3IR, the 4IR is further bringing in individuals who are fast embracing individual businesses or companies led by a key handful of people. Concepts like AI, AR, VR, IoT, robotics, autonomous vehicles, 3-D printing, nanotechnology, biotechnology, materials science, energy storage, and quantum computing merge the virtual with reality. Changes which used to take years are now converted into months and weeks.

Industries today are fast becoming disrupted with these technologies which are capable of rendering many, conglomerates and individuals alike, jobless. Typical cases in big companies were Novar plc and those mentioned above. However, even though businesses based on 4IR were disruptive on human capital, their valuations were based on projections and investments and not on the value of the company itself. Cost of the company was the exit potential it provided; mainly in trade sales or the holy grail of startups – the IPO. Technology might very well be a victim of its own success.

The Disruption

Many traditional industries which are primarily process driven, face problems of survivability and sustainability. Many are content to compete for the ever-shrinking market. While few key players continue to survive, ones without USPs or MSPs, are in clear and present danger of folding up. 3IR and 4IR provided power to the hands of small businesses and individuals. It became the great equalizer. What a small startup or SME can achieve in a few dollars would take a larger corporation weeks or months and a high budget. The digital revolution disrupts businesses and populations. Tech companies too have their own problems. Management and perception issues like those faced by Uber in the US and Housing.com in India. Wisdom and maturity are key issues ignored by these fast companies.

Advanced countries that have trained its citizens on process based thinking are in immense danger of having their jobs displaced by technology. While large companies build their own technology in-house, the problem is the objective and objectivity. Such companies have a specific direction and the in-house department solves that. Many a times the universality of application of that technology is lost. Not so with the smaller guys. Their problem-solving ability is more objective. More global. They begin ideating with the objective of scaling up, internationalizing and disrupting. But great care must be exercised with in-house tech or a tech acquisition. There are many failures such as Mattel Inc’s 1999 $3.6 billion acquisition of The Learning Company; who can forget Napster, a company in its death helped monetize customers for companies like Apple and Amazon; and my own personal favourite, Palm.

The CoAggregation

There is a solution. What is the future for SMEs if it cannot be a conglomerate or ride on 3IR and 4IR? A CoAggregate. Where smaller companies or SMEs in the same or similar sector create a larger company and co-own it. So as the age of conglomerates descend, the startup/entrepreneur/SME must also evolve. Both these forms of business need to adapt rapidly with changing their business models, collaborate, innovate and future-proof disruption. They need to survive and sustain. A process where the SMEs get together and co-own a larger enterprise while pursuing their own company interests. Creation of a matrix of complementary in-line companies – that are intertwined and where they are of the highest relevance to each other – ensures survivability and sustainability. Just as senior more experienced workers can impart invaluable experience and wisdom to millennials and millennials provide drive and innovation to the experienced, so also do traditional SMEs provide the valuable input to new and modern technologies and the latter provides not just customized, but a much broader perspective to industry applicability. Technology SMEs need the wisdom and maturity of the traditional SMEs. They must expand their business universe – together.

They must “CoAggregate”.

For partnerships, speaker and general business enquiries with 2iB Partners:

| Contact Person | Dylan Tan |

| Designation | COO |

| Dylan@2ibpartners.com |

YOU MAY LIKE

2iB Partners goes to Silk Road Summit 2018 in Zhang Jia Jie, China

M&A – The Legal Angle

M&A - The Legal Angle The solution and problem in a merger or acquisition is regulatory in nature. In all cross-border deals, there is no go-around to regulations. Laws are enacted to essential protect life and property of its citizens. Therefore, it...

Why M&As Go Wrong

Acquisitions that are rushed can result in problems and challenges after closing in a transaction: Some of the reasons why M&As go wrong are: 1. Assumption Asymmetry Leaders and owners may over value a target by making assumptions including...

[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017

In the above video, Managing Director of 2iB Partners, Mr. Yang Yen Thaw delivers a 50 minute speech on Legal issues in cross-border Mergers & Acquisitions (M&A) and a new approach to M&A. 2iB Partners formed part of a repertoire of experts...

Panelist Commentary on Fintech in Healthcare: Partnerships & Regulatory Frameworks – 27 October 2017

A commentary by Yang Yen Thaw on his views in the panel discussion on Accelerating Innovation: Partnerships & Regulations on the topic "Fintech in Healthcare". The panelists were Yang Yen Thaw, Managing Director of 2iB Partners, Astrid S. Tuminez, Regional...

8 Points to consider for an IPO

In the previous parts, for Preparing your Company for a Liquidity Event, we covered: 8 Preparatory Steps 8 Considerations 8 Legal Points For the last installment of the series, we’d like to touch on a little on the supposed “holy grail” of companies – the...

![[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017](https://2ibpartners.com/wp-content/uploads/2017/11/B87I9434-400x250.jpg)