The Conglomerate Discount

In a conglomerate model, one entity buys out many disparate entities resulting in one top management/board that all companies report upwards to.

In 1981, conglomerates had already gone out of fashion. Analysts were keen to distinguish between the failures of the conglomerate model and the leveraged buy-outs (LBOs) and mergers of the 1980s. Investment managers were skeptical on grounds that conglomerates were not transparent and disallowed investors the ability to allocate within sectors. It appeared that investors preferred a “pure play” compared to conglomerates. Instead of putting together chunks of unrelated sectors which complicated management and investment, investors preferred focused companies true to their core competencies. They wanted simple and easily understandable investment propositions.

General Electric, an S&P 500 listed company, is one of the notable conglomerates that is involved in a great variety of businesses. What was observed in the 1980’s, however, was that the PE of GE was trading equal to or less than the S&P 500. Hence there was an inherent pressure for divestments, spin-offs and carve-outs that resulted in much more efficient, customizable and nimble units.

The conglomerate discount concept refers to the stock market’s tendency to undervalue the stocks of a conglomerate businesses. It is calculated by adding an estimation of theintrinsic value of each of the subsidiary companies in a conglomerate and subtracting the conglomerate’s market capitalization from that value. The conglomerate discount arises from the sum-of-parts valuation, and it is the reason why many conglomerates spin-off or divest subsidiary holdings. -Investopedia

Investors tend to undervalue large, diversified conglomerates due to the natural limits of one board governing such a large business and those that do not have a core focus. The quality and smoothness of corporate strategy execution, to a large extent, is heavily dependent on the company’s internal corporate governance mechanisms. It is thus an indispensable task of that one board to ensure that the company’s organizational structures (e.g., the group functions), the style with which group-level management interacts with the business units, as well as the management systems (e.g., corporate planning and controlling systems, incentive systems, IT systems) are well aligned with the corporate strategy.

The board faces further difficulty since the business groups within a conglomerate sometimes lack strategic coherence and overall transparency. This can foster inefficiencies in internal and external resource allocation. Such management inefficiency is also due to the many layers of approval leading to slower decision making. A centralized conglomerate is thus less nimble and customizable in their offerings and often stifles the creativity and efficiency of each of the moving parts. Furthermore, finding cost efficiencies and reducing bureaucratic inefficiencies becomes more difficult as a company moves into more diversified and dispersed lines of business. On some occasions, these inefficiencies lead to the company receiving a conglomerate discount. Large companies, such as Apple, Exxon and JPMorgan Chase & Co., may not be subject to the discount because despite being very large, they still operate focused businesses true to their core competencies. Some examples of U.S. conglomerates that may have been treated with this discount include Proctor & Gamble and Honeywell International Inc.

Merging to form conglomerates is attractive on the surface, especially from an accounting perspective: when faced with 4 balance sheets and P&Ls, it makes perfect sense to centralize everything and squeeze out every dollar. It is widely known, that most M&As and roll-ups fail due to egos and cultural incompatibility. They also create more bureaucracy laden entities, which defeats the promise of efficiency.

Emotion also plays a role in M&A, especially with small businesses. In small business M&A, it is often a more emotional thing rather than just a pure transaction. The business owners and staff are more emotionally tied into their company. Generally, people dislike change and this includes staff and customers alike.

Merging Through a holdco structure

This is a structure involving a number of complementary companies under a holding group which may or may not be listed. However, the key premise is that all of these companies are ring-fenced and kept independent of each other with the autonomy to run their business as is. Integration wise, these companies maintain their identities and brand equity. On the holdco level, the services are integrated on a project by project basis like a jigsaw with many permutations.The philosophy is that great things happen when great minds come together.

Small to medium companies do not have the resource and the capacity to conduct an IPO and more so the rigor of running a publicly listed company. Together, with a pool of resources, they now can hire first rate talent and build the systems and processes needed to maintain the public holdco structure.

Transcending the Conglomerate Discount

Business process activities in particular can benefit from centralization: there are great benefits in shared services and out-sourcing of day to day routine operations such as payroll, finance, accounting, HR and anything administrative –even having one central secretarial pool. If a business is freed from the dead weights of such administrative tasks, it can focus entirely on profitability and growth.

By creating a company comprised of high performing, complementary, autonomic small businesses, the market is offered something unique: an industry specific conglomerate that does not suffer from the traditional downsides of a centralized conglomerate. Since each business is high performing and maintains its effective leadership, the conglomerate discount becomes a premium: the company is worth more than the sum of its parts, since it enhances the value of each of the small businesses in the group.

Instead of forcing a consummation, synergies happen by themselves in an environment where creativity and innovation are encouraged rather than stifled. Decisions are made much faster and each moving part works autonomously which makes delivering much more efficient. Each of the business owner remains in full control of their business which makes efficiency more possible. At heart, entrepreneurs are free spirits and out of the box thinkers.

Many books on management and leadership always talk about giving control and a sense of ownership. It is something really simple but very few people do it! As an entrepreneur that has built a good, solid, multi-million dollar business, they probably know their industry better than you.

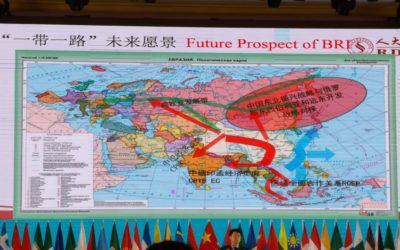

Leverage on a Global platform

Standard procurement practice dictates that you would not be able to qualify for a tender if you are not of a certain scale or capacity. However, by coming together, companies now have a much larger global footprint and financials to leverage on. By leveling the playing field, a smaller business can now have a chance at the larger contracts.

By having sister concerns in different markets, this effectively gives you market access into those markets. They know their market well enough and have the contacts needed to help you get off to a good start. This is in stark contrast to going in completely blind with a million and one counter-party risk.

Dylan Tan Director – 2iB Partners

-John Nikolaou contributed to this article

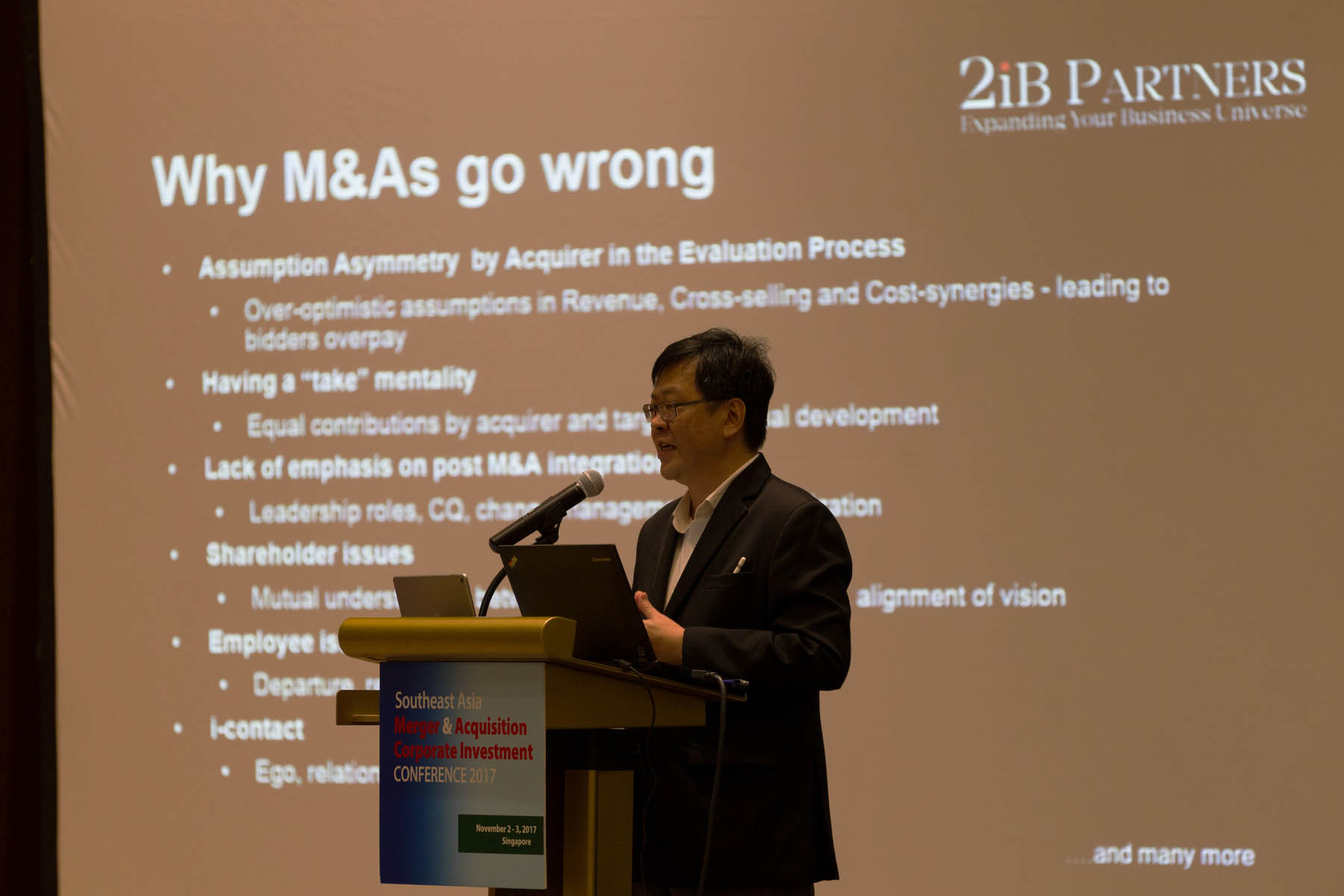

![[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017](https://2ibpartners.com/wp-content/uploads/2017/11/B87I9434-400x250.jpg)

![3 Key Notes Before Entering a New Market [Video & Transcript]](https://2ibpartners.com/wp-content/uploads/2017/06/map-1862587_1920-1080x675.jpg)

![[Video] 2iB Partners Speaks at Southeast Asian M&A and Corporate Investment Conference 2017](https://2ibpartners.com/wp-content/uploads/2017/11/B87I9434-1080x675.jpg)